Buying a home is one of the most significant financial decisions you’ll ever make, and understanding mortgage deeds is crucial to this process.

That is why I decided to write a detailed guide, designed to uncover the meaning behind the essential documents, helping you grasp their importance, components, and the overall mortgage process.

Without further ado, let us go.

The First Thing to Know

A mortgage deed is a legal document that formalizes the agreement between a borrower and a lender. It secures the lender’s interest in the property until the loan is repaid in full.

The mortgage deed is crucial because it provides the lender with the right to foreclose on the property if the borrower defaults on the loan.

Key components of a mortgage deed include:

- The identification of the parties involved

- A legal description of the property

- The loan amount, interest rate

- Repayment schedule

- Terms and conditions of the loan.

It outlines the borrower’s obligations, such as maintaining the property and paying property taxes and insurance.

Understanding the purpose and significance of a mortgage deed helps borrowers comprehend their responsibilities and the lender’s rights.

It ensures that both parties are aware of the terms of the agreement, providing a clear framework for the financial transaction.

Knowing these basics is the first step in navigating the complexities of mortgage deeds.

Types of Mortgage Documents

The next thing we want to talk about is the different types of mortgages.

Loan Estimate

The Loan Estimate is a crucial document provided by lenders that outlines the estimated costs of the mortgage loan.

Key sections of the Loan Estimate include:

- Loan terms

- Projected payments

- Costs at closing

- Additional information

- Taxes

- Insurance

Closing Disclosure

The Closing Disclosure is provided to borrowers at least three days before closing the mortgage.

Key sections of the Closing Disclosure include:

- Loan terms

- Projected payments

- Closing costs

- Summary of the transaction

Promissory Note

The Promissory Note is a legal document in which the borrower promises to repay the loan.

Key sections of the Promissory Note include:

- Loan amount

- Interest rate

- Repayment terms

- Borrower’s signature

Mortgage or Deed of Trust

The Mortgage or Deed of Trust is a legal document that secures the loan by providing the lender with a claim on the property.

Key sections of the Mortgage or Deed of Trust include:

- Identification of the parties

- Property Description

- Loan terms

- Borrower’s obligations

Right to Cancel Forms

The Right to Cancel Forms provide borrowers with the right to cancel certain types of loans within three business days.

The right is granted under the Truth in Lending Act and applies to loans secured by the borrower’s primary residence.

Key sections of the Right to Cancel Forms include:

- Notice of the right to cancel

- the deadline for cancellation

- Instructions on how to cancel

Preparing for a Mortgage

You should not take a mortgage before a preparation.

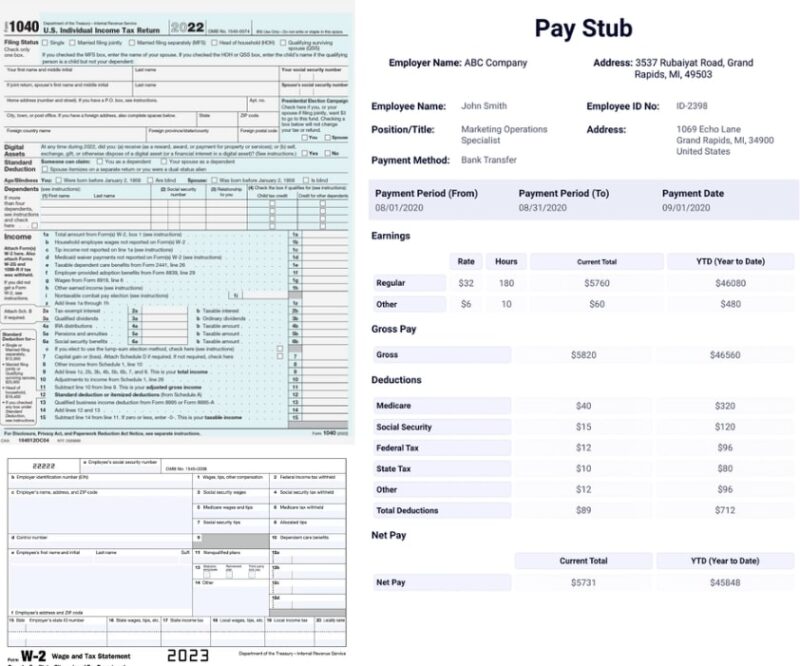

Documents Needed for Mortgage Prequalification

To prequalify for a mortgage, borrowers need to provide certain documents to demonstrate their financial stability.

These documents typically include income verification, credit reports, and asset and liability information.

Income verification can be provided through:

- Pay stubs

- W-2 forms

- Tax returns

The credit report shows the borrower’s credit history and score, while asset and liability information includes bank statements, investment accounts, and details of any outstanding debts.

Having these documents ready helps streamline the prequalification process, allowing lenders to assess the borrower’s financial health and determine the loan amount they may qualify for.

It also gives borrowers an idea of what they can afford, helping them set realistic expectations.

Documents Needed for Mortgage Application

Once prequalified, borrowers need to gather additional documents for the mortgage application.

These include:

- Proof of income

- Tax returns

- Bank statements

- Renting history

- Gift letters if applicable

Proof of income may involve recent pay stubs, employment verification letters, or profit and loss statements for self-employed individuals.

Tax returns provide a comprehensive view of the borrower’s income and financial situation over the past two years.

Bank statements show the borrower’s savings and financial stability while renting history demonstrates their ability to manage housing payments.

Gift letters are necessary if the borrower is receiving financial assistance from family or friends.

These documents provide a complete picture of the borrower’s financial situation, allowing lenders to make an informed decision on the loan application.

Signing a Mortgage Deed

The next thing I would like to pay attention to is signing a mortgage deal.

Process of Signing a Mortgage Deed

Signing a mortgage deed is a critical step in the home-buying process.

It involves several steps to ensure the accuracy and legality of the document.

Borrowers should review the mortgage deed carefully, verifying all details such as the loan amount, interest rate, repayment terms, and property description.

Any discrepancies should be addressed before signing.

Legal Requirements and Witness Requirements

In many jurisdictions, signing a mortgage deed requires the presence of a notary public or witnesses.

It ensures the authenticity of the document and protects against fraud.

Borrowers should be aware of the specific legal requirements in their area to ensure compliance.

Steps to Ensure Accuracy Before Signing

Before signing, borrowers should take steps to ensure the accuracy of the mortgage deed.

It includes reviewing all terms and conditions, confirming the loan details with the lender, and seeking clarification on any unclear points.

It is advisable to consult with a legal professional to review the document and provide guidance.

Terms and Conditions

Of course, signing anything before being fully aware of the terms and conditions is a no-no.

Repayment Schedules

Repayment schedules outline the borrower’s monthly payment obligations. These schedules can vary based on the loan type, interest rate, and term.

Interest Rates and Their Implications

Interest rates significantly impact the cost of the mortgage.

Fixed-rate mortgages have a consistent interest rate throughout the loan term, while adjustable-rate mortgages (ARMs) have rates that can change periodically.

Borrowers should understand how interest rates affect their monthly payments and overall loan costs.

Security and Collateral Details

The mortgage deed outlines the security and collateral details, specifying the property as collateral for the loan.

It means that if the borrower defaults, the lender has the right to foreclose on the property.

These details helps borrowers comprehend the risks associated with the mortgage.

After Signing the Mortgage Deed

Now that you’ve done it, what’s next?

What Happens After Signing

After signing the mortgage deed, the transaction is not yet complete.

The lender will record the mortgage deed with the local government, making it a public record.

This step is crucial as it establishes the lender’s legal claim on the property.

Final Steps in the Transaction

The final steps in the transaction include disbursing the loan funds, which are used to pay the seller and cover closing costs.

The borrower will receive a detailed closing statement outlining all financial aspects of the transaction.

It’s important to review this statement carefully to ensure accuracy.

Long-Term Implications and Commitments

Signing a mortgage deed commits the borrower to long-term financial obligations.

It’s essential to understand the implications, including the monthly mortgage payments, property maintenance, and potential impact on credit.

Being aware of these commitments helps borrowers plan their finances and manage their mortgages effectively.